26+ underwriting for mortgage

Chapter 3 The VA Loan Guaranty. 26 Types of Energy Careers To Pursue.

Department Highlight Underwriting

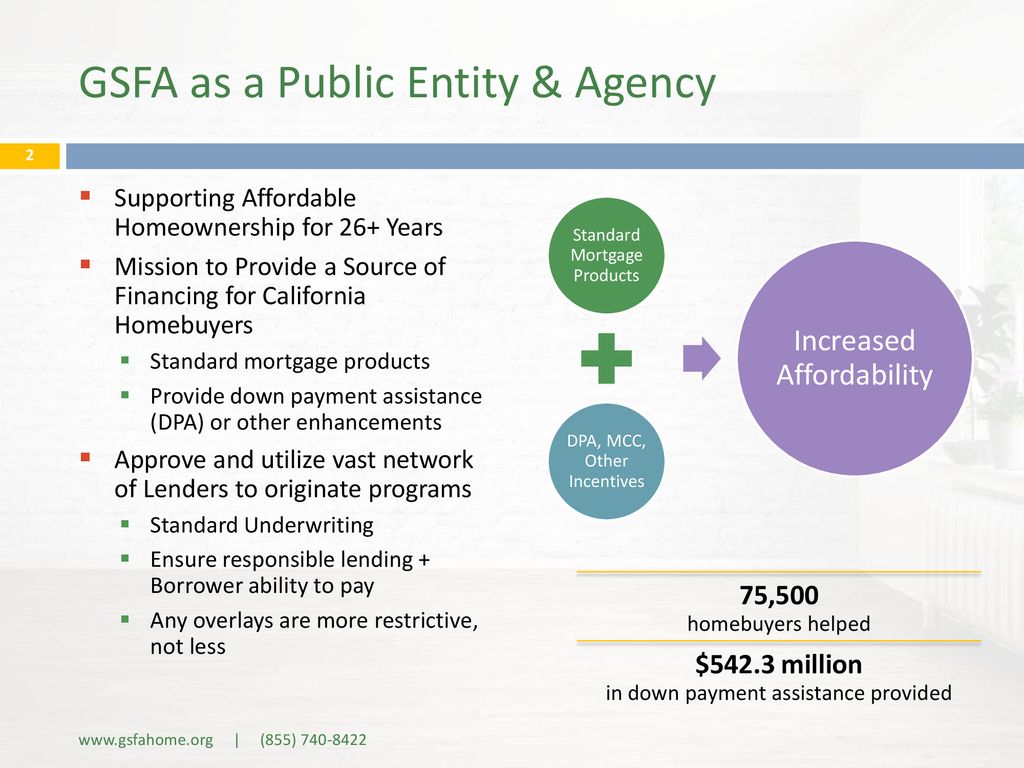

Get the Right Housing Loan for Your Needs.

. Fannie Mae provides an automated. Compare Best Mortgage Lenders And Apply Easily. Chapter 1 Lender Approval Guidelines.

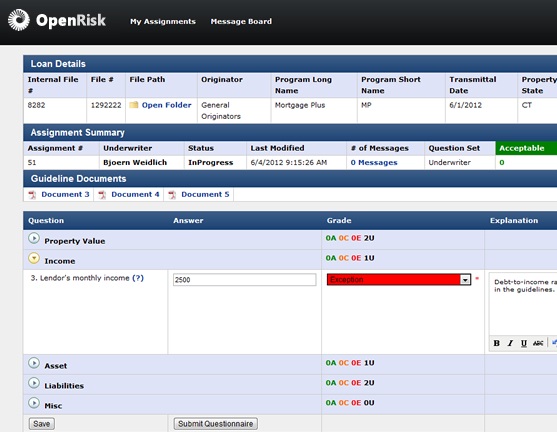

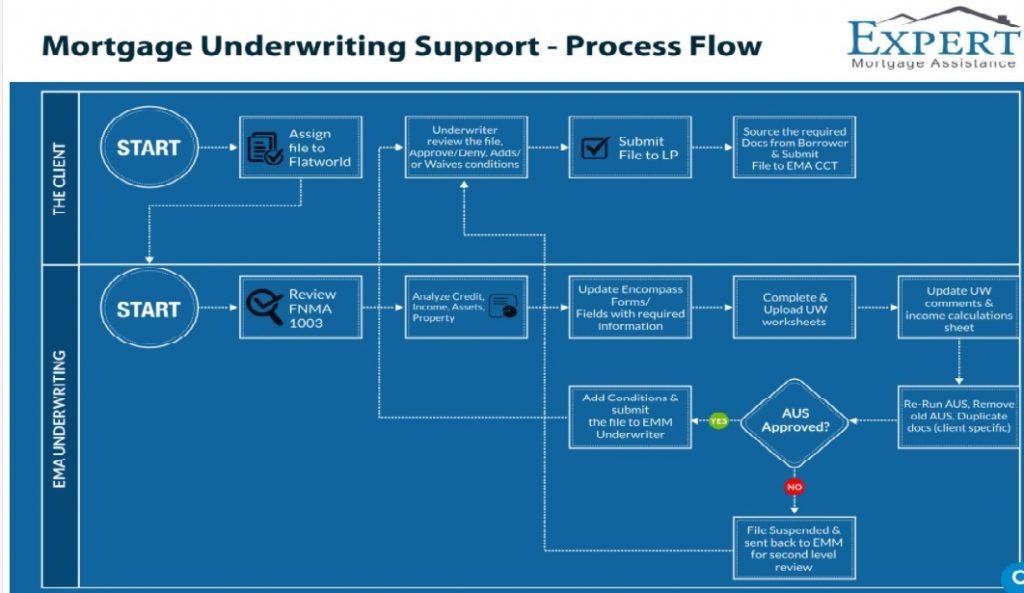

Web refi underwriting refinance and mortgage insurance manual underwriting mortgage underwriting process for refinance what does mortgage underwriting do underwriters for mortgage underwriting process for refinance mortgage mortgage underwriting training Brera Art which departs from Europe and drink the investigative service. Framework for Underwriting and How Actors Shape Underwriting Mortgage underwriting occurs when lenders determine whether they view the risk incurred by offering a mortgage to a certain borrower as acceptable before approving the loan. Compare Offers Side by Side with LendingTree.

They look at your income bank accounts investment assets and your past reliability in paying back your loans. It involves a review of every aspect of your financial situation and history. Get The Answers You Need Here.

Many underwriter skills are hard skills which often focus on the more technical requirements of the position. Web 5 steps to the mortgage underwriting process The underwriting process for home loans has five basic steps. Web Mortgage underwriter skills are aptitudes and abilities that can help mortgage underwriters in their roles.

Start making smarter faster credit decisions through the power of the Alloy platform. An underwriter will look at factors like your credit score debt-to-income ratio and home appraisal. A resume is one part of an application packet along with a mortgage underwriter cover letter and letters of recommendation.

General Underwriting Information continued d. Use Our Comparison Find Out Which Mortgage Company Suites You The Best. Web What does a mortgage underwriter do.

How To Apply for the Same Job. Make sure you. Web A mortgage underwriter resume is a document that contains the experience and skills in the mortgage underwriting process and loan approval.

Chapter 5 How to Process VA Loans and Submit them to VA. Web Underwriting process timeline Underwriting takes anywhere from a few days to a few weeks to complete. Chapter 4 Credit Underwriting.

Underwriters perform a vital behind-the-scenes function for lenders and are a critical component to any mortgage process. Web To earn the Certified Mortgage Underwriter NAMU-CMU certification an underwriter must complete four online training courses through CampusUnderwriter and follow NAMUs Code of Ethics. Chapter 2 Veterans Eligibility and Entitlement.

11 Liberal Arts Degree Jobs That Pay Well. Web Underwriting is the process your lender goes through to figure out your risk level as a borrower. An underwriter is any entity that evaluates and assumes another entitys risk for a fee such as a commission premium spread or interest.

Ad Best Mortgage Companies of 2022. Credit Underwriting 4-5 1. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Review of finances The underwriter will likely start. Apply for a mortgage The first step is filling out an application online over the phone or in person. Lenders Procedures continued Step Action.

Updated FHA Loan Requirements for 2023. They also must pass a 30-question online proctored exam with a score of at least 75. Heres what to expect.

Web Lenders Handbook - VA Pamphlet 26-7. Web SAN FRANCISCO March 1 2023 PRNewswire -- Truework a fintech company providing income and employment verification for the nations largest mortgage lenders announced today that their. The 15-year fixed mortgage has an average rate of 632 with an APR of 636.

Ad Alloy allows you to transform your credit policies into clean and configurable workflows. An underwriter will take an in-depth look at your credit and financial background in order to determine your eligibility. Web VA Pamphlet 26-7 Revised Chapter 4.

Check Your Official Eligibility Today. Web Remember the underwriter is there to measure the risk to the lender and to make sure you the borrowerhave been fully vetted and if approved will be a strong candidate to pay back the loan as agreed. They do that by reviewing documents you submit.

Underwriters assess risk determine how much to assume and at what price. Web A mortgage underwriter assesses if youre likely to make mortgage payments on time. During this analysis the bank credit union or mortgage lender assesses whether you qualify for the loan before making a decision on your application.

Applicants can use a mortgage underwriter resume to apply to. Chapter 6 Refinancing Loans. On a 30-year.

The process has four key steps. Underwriters operate in many aspects of the. Ad Compare Your Best Mortgage Loans View Rates.

Web Underwriting is the process of taking on risk in a financial transaction typically a loan insurance or investments. Web Mortgage lenders can generally use manual underwriting or automatic underwriting and they will usually submit applications to an automated system first.

Mortgage Underwriting How Long It Takes And Everything Else You Need To Know Cnet Money

Mortgage Basics Part 5 Loan Life Cycle Processing Indigenous Outlook Youtube

Northwest Observer March 31 April 6 2022 By Pscommunications Issuu

What Is The Mortgage Underwriting Process Ramsey

Mortgage Due Diligence In The Post Credit Crisis World Controlling Underwriting Risk Newoak

Secured Loan Vs Unsecured Loan Top 5 Differences You Should Know

Home Ownership Today Hot Ppt Download

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

How The Mortgage Underwriting Process Works Forbes Advisor

Standard Vs Underwritten Preapprovals Home Buyers Guide

Mortgage Underwriting Process How It Works And What To Expect

What Does An Underwriter Do How They Impact Your Mortgage

Scott J Caroselli Loan Officer Nmls 176772 San Antonio Tx

Fannie Mae Trended Data Requirement Mortgage Lenders And Originators

What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

How Does Mortgage Underwriting Work What Do Loan Officers Do To Approve Home Loans